Last week I saw a post (from 2012) with a marketing term that I hadn’t encountered before: profit horizon.

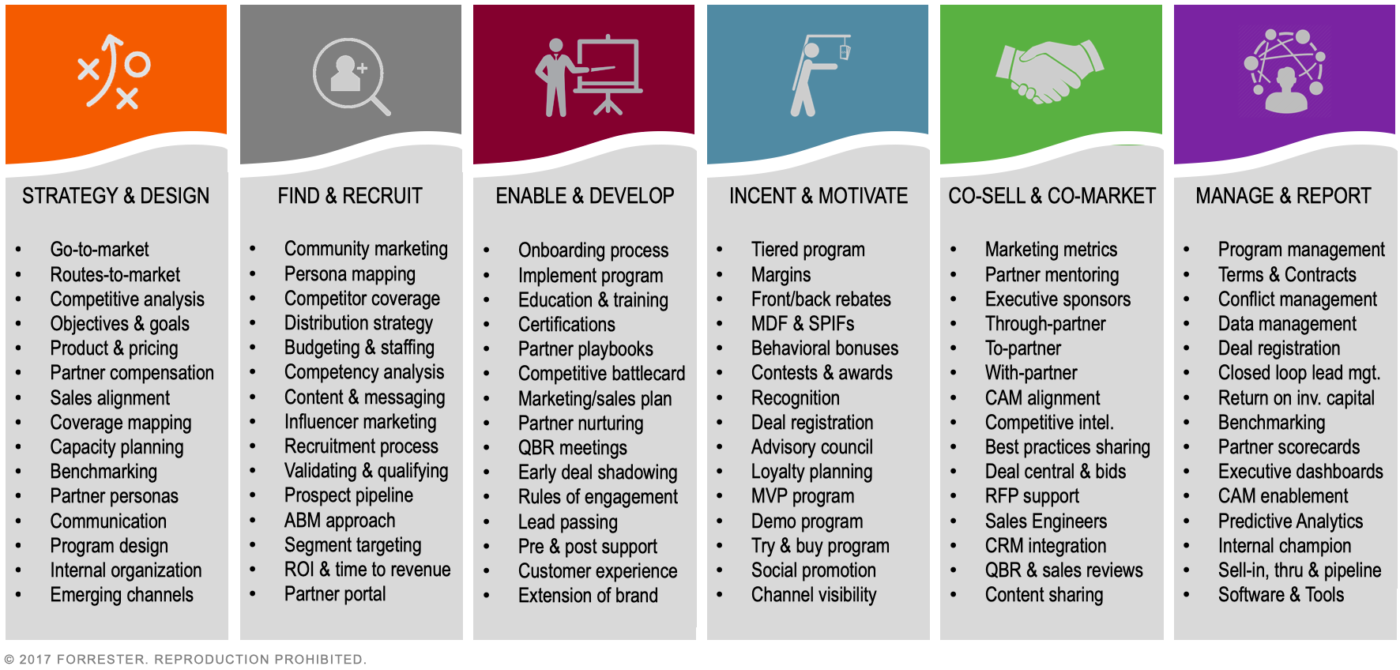

The idea (or question) is, What’s your timeframe for getting a profit from this marketing program?

A big brand like Coke or P&G may have profit horizons for some of their branding campaigns of two years or more.

Companies running search ads and other direct response programs may have profit horizons of a few weeks.

The strategies and tactics available to you differ depending on your profit horizon. You wouldn’t use national TV branding commercials if your profit horizon is very near, but you might run 2 AM direct response TV ads.

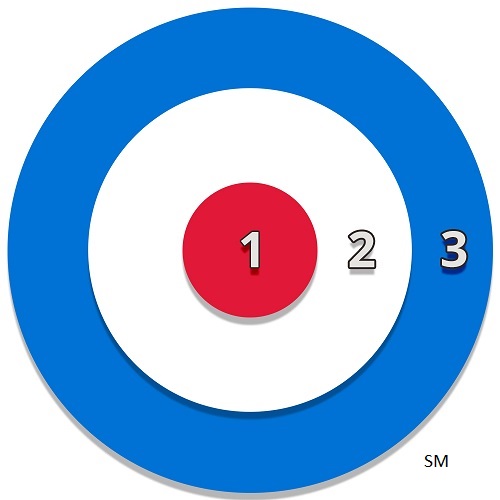

Although I’d never heard the term, the profit horizon was on my mind when I developed my Bullseye Marketing approach.

In the center of the Bullseye you’re implementing programs that are likely to produce results in just a few weeks or months – and they lay the foundation for success of second and third phase programs.

The second ring has a similarly near profit horizon because it’s based on using intent data to find out which customers are in market now, so you can get your advertising in front of them.

Then in the third ring are the long-term branding and awareness programs that can generate great results in the long-run, but are unlikely to generate hardly any new sales for a year or two.

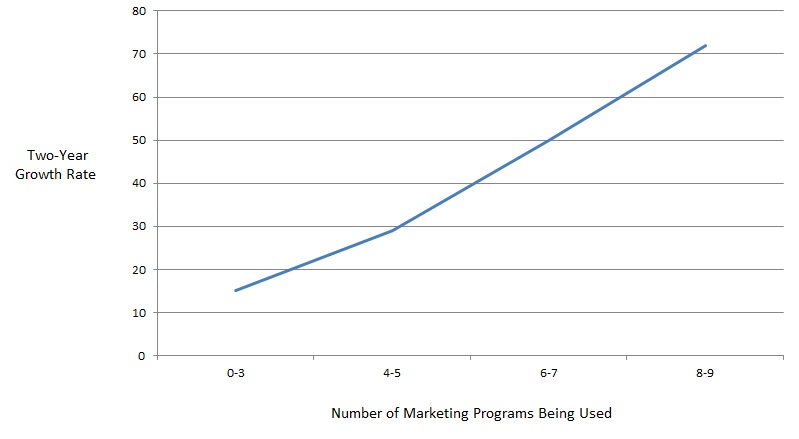

A critical mistake that many companies that don’t have robust marketing programs make when first launching and ramping up ones is to start with third phrase programs that get a lot of buzz – like social media and content – without realizing how long they take to produce results. When they don’t see any impact after six months or so they are likely to say, “We knew it: marketing doesn’t work for us.”

But it can work if you understand your profit horizon, the Bullseye Marketing approach, and which programs can produce results in the timeframe that you’re targeting.