Companies that market more and better grow faster. Deloitte estimates that enterprises dedicate about 11% of their expenses to marketing. That’s how they got big; it’s not like they got big, had all this extra cash lying around, and said, “Let’s waste it on marketing.”

With B2B small- and mid-sized businesses (SMBs), though, the situation is quite different. Most B2B SMBs greatly under-invest in marketing, to their own detriment.

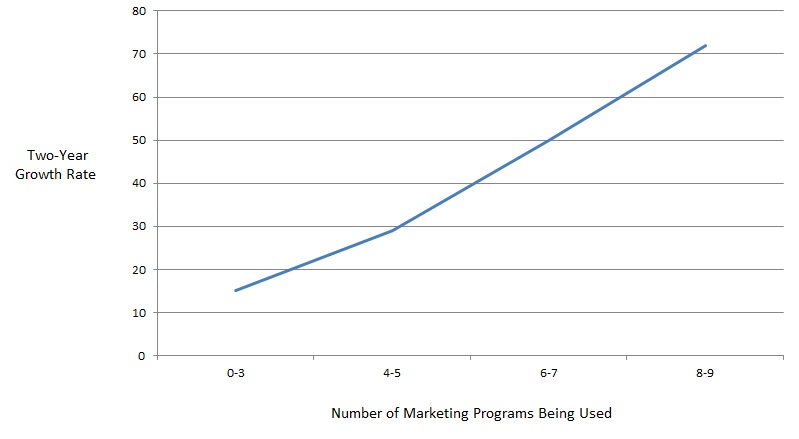

I studied the marketing programs of 351 SMBs with about 50-1000 employees. Using my nine-point digital marketing scorecard, I could tell how many programs such as social media, search engine optimization, content marketing, and marketing automation companies were using.

The results were somewhere between sobering and shocking. I uncovered a major divide between the 85 software companies in the study, which were using a median of 7 of the 9 programs, and the 266 non-software companies (in industries such as professional services, medical devices, and manufacturing) which were using a median of just 2 of the 9 programs. Since digital marketing is central to any modern marketing program, and companies got one point just for having Google Analytics on their website, essentially most of these non-software firms were not marketing.

These are not solopreneurs or very small companies; many of these companies have been around for decades. These companies are the heart of the U.S. economy; the Census Bureau reports that companies with 50-1000 employees employ more than three times as many people as enterprises with 1000+ employees.

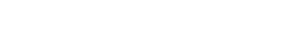

And it matters. As I said, companies that market more grow faster. Among those software companies, the ones that were using 8 or 9 of the programs were growing about five times faster than those using 0-3 of the programs.

Other studies in other industries have found similar results. For example, a 2016 study by Velocify of over 1,000 insurance agencies showed that the agencies that spent the most on marketing grew much faster than those that spent little. They all got leads from recommendations, but those companies with robust marketing programs got leads and sales through other channels, too.

My original research was done in 2014. (You can download it here and learn more about the methodology.) Recently I redid my survey with the same 351 companies to see if anything had changed with those non-software companies. . Little had. The median of the non-software companies only rose from 2 to 3. That rise is due almost totally to one thing: new, mobile-friendly (responsive) websites. Most companies redo their websites about every four years or so. In the redesigns since 2014, the web developers made the new sites responsive, whether clients asked for that or not. While in 2014 only one in five of the non-software companies had mobile-friendly websites, today four out of five do. But the use of most of the other marketing programs has changed little; a few actually declined.

These results also make intuitive sense to me, for what that’s worth. Of course the number of responsive websites would have increased significantly. And social media gets so much buzz that if companies are going to try one thing, they’re going to post for free at least daily (or weekly on LinkedIn, my very low standard). This social media activity, though, isn’t going to do much since not part of an integrated marketing program.

And the least-popular programs in 2014 are even less popular now. After all, PPC clicks are more expensive so if your program was marginal before then it might be unprofitable with higher CPCs. And most content programs don’t produce results: 9 out of 10 pieces of content get no organic search traffic (as in zero), and companies need to optimally post a new blog piece at least 11 times a month to produce significantly more leads. That’s twice the frequency that I required in my study and very few companies were doing even that. Even HubSpot’s CEO now has turned to saying that inbound marketing works “at scale”; for them the scale was the spending of tens of millions of VC dollars.

Why are so few non-software companies marketing?

There are three major reasons why non-software companies market so little:

- Marketing is not in their DNA. Most company founders are experienced and skilled in their industry, and they had to become at least competent at sales or their company would not have survived, but they had little or no exposure to marketing along the way. They may see marketing as an expense rather than an investment in growth.

- Marketing has become so complex. While thirty years ago there were only a few ways for companies to reach their customers — such as direct mail, print, radio, TV, and events — today there are dozens of marketing channels; some people have put the number of channels at over 100. With thousands of companies selling marketing software in dozens of categories, and thousands of additional vendors and consultants all making competing claims, even experienced marketers can be overwhelmed. Executives with little marketing experience are even less prepared to figure out what to do, or how to manage employees and vendors in marketing.

- What works in marketing changes rapidly. What worked in digital marketing 10 years ago, or even five years ago may not work well today. What works today may not work in five years. Companies need to be constantly experimenting, testing, and adjusting their marketing programs based on actual results, not theory. As Jay Acunzo says, it’s all about finding the best approach for you.

The people at software companies are more comfortable with the technology and data and testing that are central to marketing today.

But most non-software SMBs do little or nothing. And they lose out as a result.

Bullseye Marketing: The way forward

In working with companies of all sizes and in many industries, I’ve developed a low-risk approach for them to launch and scale marketing programs. They can use this approach to achieve quick wins and build the internal buy-in needed to scale marketing programs that can drive business results. I call it Bullseye Marketing, and described it in detail in my book of the same name.

Bullseye Marketing involves three phases, as illustrated in this graphic.

Phase 1: Fully Exploit Your Existing Marketing Assets

Companies that have been around for even just a few years have typically developed considerable marketing assets, but most don’t realize their value and they fail to fully exploit them. Some of these assets include:

- Their customers and customer knowledge

- Traffic to their Website

- Email lists

- How sales and marketing teams collaborate

By taking better advantage of these and other marketing assets, companies can often improve their results quickly and inexpensively. It costs nothing besides staff times to listen to your customers, or for sales and marketing to work together better, and little to undertake an email marketing program, implement compelling calls to actions or chat on your website, or setup remarketing. Just improving the calls to action and conversion devices on your website can quickly double or triple website leads in a few weeks. Selling more to current accounts is typically 5-25 times less expensive than closing a new account, but many companies focus too much on new customers.

And these center-of-the-Bullseye programs establish a foundation for success in Phases 2 and 3.

Phase 2: Sell to People Who Want to Buy Now

B2B markets are typically much smaller than we think, because – unlike a company that’s selling something that’s used frequently, like food — most companies aren’t in-market for most products and services. Vendors that hyper-focus their new customer efforts on those that are will achieve much greater success at a much lower cost.

- Search ads tied to certain keyword phrases are likely to target people and companies who are in-market and plan to buy soon.

- Companies can monitor surges in interest in their content by people and companies – such as visits to their website, downloads, attendance at webinars, and opens and shares of their emails – that can indicate deeper interest and buying intent.

- Third-party vendors aggregate search data across many industry sites and use it to identify companies that are in-market now, and then sell those names to vendors.

All of these are ways that companies can target customers that intend to buy soon, which is the second ring of the Bullseye.

Phase Three: Cast a Wider Net

In the third phase, companies use programs like social media, content, display ads, and events to build their brand and awareness of their offerings. These programs can take two or three years to produce meaningful results, unless done at a massive and expensive scale, but in the long run the inbound leads that they develop often close at a higher rate than any except for those from current customers.

Unfortunately, programs like social media and content marketing are so identified with marketing that when many companies try to ramp up their marketing they start with them. These programs are unlikely to drive rapid results, though. McKinsey estimates that center-of-the-Bullseye email marketing is 40 times more effective for customer acquisition than Facebook or Twitter. Based on my experience, I agree.

Companies that start with these outer-ring programs are unlikely to see a fast return. After six months or so they may say, “We knew marketing doesn’t work for us” and pull the plug on marketing altogether.

But by utilizing the Bullseye Marketing approach, companies that until now have under-invested in marketing can transform themselves and achieve much faster growth.