This is chapter 3 of Louis Gudema’s Bullseye Marketing book, which is available on Amazon..

This may seem obvious, but it’s not obvious to everyone who starts a business: building your business begins with understanding your customer, and then delivering products and services that they are willing to pay enough for that you can make a profit.

And while many people think of marketing as just being about advertising and promotion, the central role of marketing is actually understanding the customer – the market – and working with the rest of the company to create those products and services that will have a chance for success. And then promoting them and generating demand. This is the most strategic role of marketing. Bullseye marketers can start contributing to this in weeks, and it should be a constant activity going forward.

It’s not enough to build a better mousetrap if the world is happy with the mousetraps that it already has. Companies introduce tens of thousands of new food products annually and most sink without a trace — and that’s just food products. Millions of apps have been developed for Apple, Android, and other platforms, but most get very little usage and even fewer make a meaningful amount of money. Overall it’s estimated that less than 10 percent of new products are still being sold two years later.[i] Many great products have failed because the company was too early to market, too late, or it was delivering something that — good as it was from a technical or aesthetic point of view – simply wasn’t what customers were willing to pay for.

Products and services can have many purposes. Some are necessary for survival, to do things faster and easier, or for knowledge, entertainment, joy, even status. But in business, if the customer isn’t willing to pay for it, it doesn’t have a value.

Ways to do customer research

As a Bullseye marketer, you need to base your product development and promotions on a genuine understanding of your customers. Don’t guess. The first step in gaining customer knowledge is to do research. Here are a few ways to learn about your customers.

Talk to your customers!

The number one way to do customer research is to talk to them! Again, this may seem obvious, but when working with companies, especially startups and small companies, I am amazed at how many executives are resistant to simply sitting down and talking with even a few dozen of their potential customers. But these conversations are by far the fastest, most inexpensive and valuable input they could get when launching a new company or product.

Don’t just think about who you want to serve, what you think they would find valuable, and whether you can reach them with your offering: talk to them! You’ll find people can be remarkably helpful if you say (1) you don’t want to sell them anything, and (2) you do want to know what they think and feel.

These are an example of questions that I use when interviewing the customers of a services company:

- What services are you using them for?

- Do you remember how you first heard of them?

- What other companies were you considering?

- Why did you decide to use them?

- How do you feel about the service that they provided? (“feel” rather than “think” to try to elicit emotional responses)

- How could they make your business more successful over the next 1-2 years?

- When choosing a company for this, which are the three most important considerations? Please rank 1, 2 and 3

- Industry reputation

- Quality of work

- Timeliness of work

- Responsiveness

- Price

- Expertise

- Other? (What?)

- If their prices had been 10% higher, would you have chosen them anyway? 25%?

- What are your major sources of industry information?

- What else would you like to tell me that I haven’t asked?

Depending on the company and the service, the questions can be much more detailed.

And those are just a few initial questions. Key to successful interviews is making them a conversation. Listen to how the person responds and ask follow-up questions.

Ideally, you want to talk in person or via a web conference so you can see their expressions when you ask them how they use a product or service, and what they would like and not like.

If you’re talking about a new, physical product, you should show them an inexpensive prototype or let them try a sample. But keep the costs down in your first round of research. You could initially use artist renderings or sketches and save on developing production samples until you get favorable feedback. Or print an inexpensive 3D prototype. For a new app or software program, your sample could be as simple as a set of screen – perhaps just “wireframes” that show functionality but have no real colors or design, and have no (expensive) programming behind them.

It’s important that the people that you’re talking with feel comfortable to share with you their true feelings. You don’t want them to be “nice” and just tell you that they think that your service, or your idea for a new product, is great when in fact they don’t. You can straight out tell them that you want their honest reactions and feedback, and that they should not be nice, and maybe that will work. Or maybe you will need to have people in your company that they don’t know talk to them, or even hire an outside researcher to do the interviews.

And here’s a little secret: often this is not just great research. If you have a good idea for a new product probably 20 percent or more of the people you talk with will say, “If you really go ahead with this let me know; I would love to buy it.” (If they don’t say this, that could be a red light.) But don’t try to sell it to them; let them make that kind of remark.

Now, I know, Steve Jobs didn’t do customer research. He would dismiss it with an apocryphal quote from Henry Ford who supposedly said, but never actually did, “If I had asked customers what they wanted they would have told me ‘a faster horse.’” So Steve Jobs was able to develop great products without talking to customers, great: he was a one in a billion genius. He also had many notable failures such as the Apple III and Lisa. For the rest of us, it’s way better if we talk to customers.

Regular, 30-60 minute conversations with customer should be a part of your ongoing marketing and customer retention/growth programs, not just when launching a new company or product. They can be invaluable. I was doing interviews for one client who swore that his customers only cared about price. The very first customer of his that I asked to rank the top three most important buying considerations immediately said, “Well, price isn’t in the top three.”

And be ready for some of your customers to be unhappy. I was doing interviews for one company and the CEO said, “I don’t know why we’re talking with our unhappy customers. We know they’re unhappy. It just reminds them of that.”

Wrong attitude! Heed the words of Bill Gates, “Your most unhappy customers are your greatest source of learning.”

Online forums, social media and review site

As a Bullseye marketer, in Phase 1 we’re especially interested in that which is fast, inexpensive and effective. You don’t necessarily need to hire a market research firm to understand what’s important to prospective customers. You can often gather free customer insights from masses of people through public sites and industry forums on which people review products and services. Go online and read what your customers are saying about the good, bad and ugly of your existing products, and those of your competitors.

Look at sites such as Facebook, LinkedIn, Twitter, Amazon and Yelp. And technology review sites like Capterra and G2Crowd. What’s going on in the conversation about the industry, and the conversation around particular companies and products? What do the customers like? What are their gripes? Are there patterns that can help you identify an unfilled need?

You can use special software tools to help you monitor the social media universe to see what people are saying about you, your industry and competitors outside of your usual social media channels. These range from very deep, expensive programs to free ones with more limited capabilities

Internet research

The Internet is a great market research tool. Online you can, for example, find out:

- the demographic breakdown of the United States, or of a particular city or state[iii]

- the number of people serving in the military, and the states with the highest numbers

- the wealthiest towns

- trends for commercial bakeries[iv]

- the size of the market for learning management system software

- size and growth of cloud hosting[v]

- how many Mexican restaurants there are in San Antonio

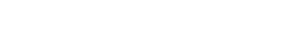

Or this nugget from the St. Louis Federal Reserve on the decline in greeting cards sales over the past 15 years.

With a little online research, you can find out almost anything.

Google Trends and AdWords

Google is your friend. Aside from searching on Google, two useful research tools are Google Trends and Google AdWords.

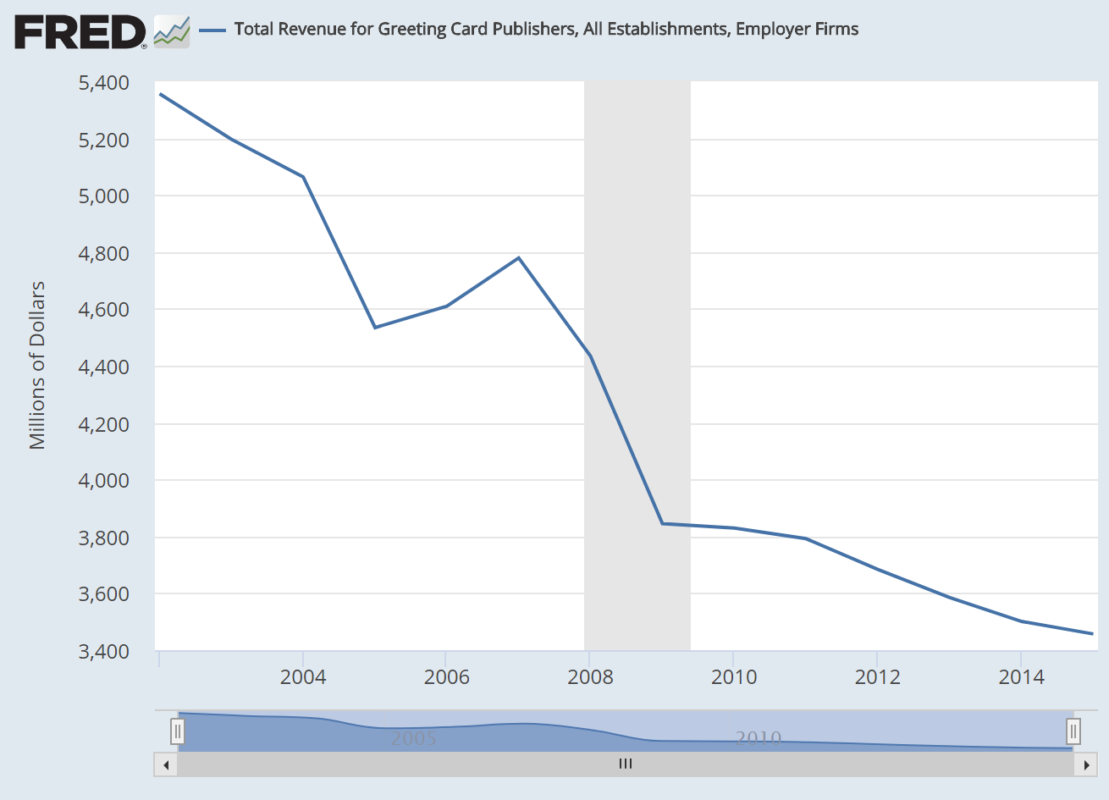

In Google Trends (www.google.com/trends) you can see how the search interest in terms changes over time, and how strong it is relative to other related items. For example, this Trends chart for cookies (blue), cakes (red) and pies (yellow) shows a very big annual spike in interest in cookies every year around Christmas, with a corresponding decline in interest in cakes; a much smaller bump for pies happens around Thanksgiving. And interest in all three continues to rise steadily.

If you’re thinking of starting a bakery, this data on cookies, cakes, and pies could be very valuable information.

Google AdWords isn’t just an advertising platform; it also provides very valuable market and customer insights.

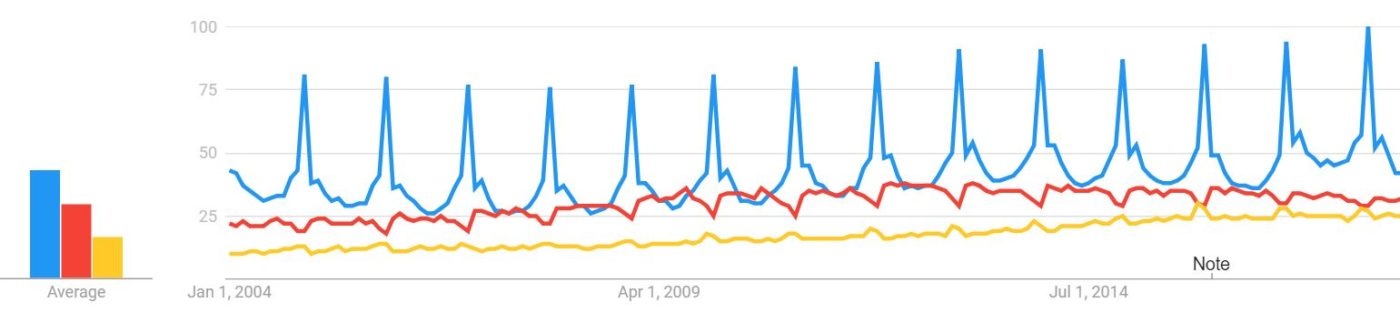

In the AdWords Keyword Tool, you can put in a few keywords and it will show you many related terms, how many searches are done nationally and globally each month for those terms, how competitive the market is for those keywords, and estimated cost per click if you decide to advertise for that keyword.

If I were starting a bakery that would be making cookies, some type of chocolate chip would definitely be on the menu!

Launch a search campaign on AdWords or Bing, and very quickly you’ll find out what keywords people are using to search for your products and services, which ad messages compel them to click and what offers get them to take an action.

Market research resources

Market research and analyst firms regularly conduct market research for companies on virtually any topic. These can give you valuable feedback from hundreds of people – a statistically significant sample – but may cost tens of thousands of dollars. Some online market research tools exist for those with a smaller budget and do-it-yourselfers. These let you survey hundreds of consumers for only a few thousand dollars; I’ve listed a few in the tools section at the end of this chapter.

You don’t have to do all of this research alone, either. There is someone who is often happy to donate her time to help you with your research: your local librarian. Your librarian may have access to many business databases with valuable information.

First establish product/market fit

In the startup world, product/market fit is everything. And although it’s not talked about as much in more mature companies, it’s critical for them, too.

You achieve product/market fit when you have both a market, and a product that addresses the needs and pains of that market.

There is nothing more classic than an engineer inventing a very elegant new something that is technically the best in its class, and yet it fails as a business. What the engineer thought was important to people was not what the customers actually cared about.

The best way to establish product/market fit is by talking to customers. Talk to dozens of potential customers before developing a new product; the National Science Foundation I-Corps program[i] requires teams to interview at least 100 potential customers. I’ve seen companies who didn’t do their customer research spend millions of dollars on a new product only to find out when it’s ready that the market simply doesn’t care.

And no amount of advertising and promotion can save a product that doesn’t have product/market fit.

Understanding your customer’s emotional triggers

“The difference between the almost right word and the right word is really a large matter – it is the difference between the lightning bug and the lightning.” – Mark Twain

People buy with emotion and justify with logic. And it applies to people whether they’re buying for themselves or for the company that they work for.

For consumers, the emotional triggers can be many. They buy because something makes them feel fashionable, smart, frugal, modern, or traditional. They buy food because it seems tasty, healthy, or indulgent. One person will want to buy a car that is powerful and loud, and another person will want a car that is self-effacing and green.

In corporations people often buy for emotional reasons, too, even putting the personal career impact of the purchase above the company’s interest. For many people at work, the single most important emotion is risk avoidance: they don’t want to do anything that could jeopardize their job. That’s why, as they used to say, “No one ever got fired for buying IBM.”

One prominent venture capitalist goes so far as to say that startups aren’t selling software, they’re selling job promotions,

I’ve done a lot of marketing work with small colleges and private schools. One year the director of admission at one prominent school tracked whether accepted students revisited on sunny or cloudy/rainy days. He found that those who revisited on sunny days were 10 percentage points more likely to enroll than those who visited on days with bad weather. The school wasn’t any different – that’s a decision based on emotion.

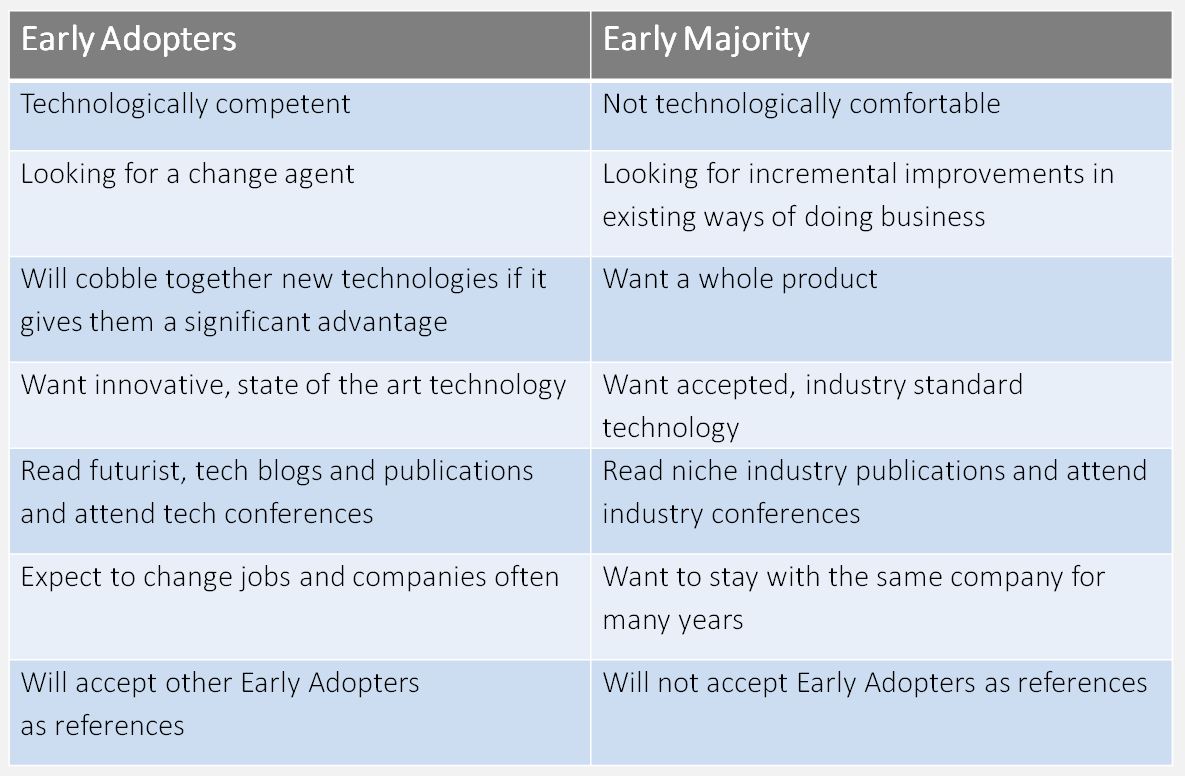

A classic book about high tech marketing is Geoffrey Moore’s Crossing the Chasm. In it he describes how difficult it is for early-stage tech companies to move from selling to geeks and early adopters to selling to customers in the mainstream of the market because the attitudes of the people in the mainstream are so different from those of the early buyers. Here are some examples of the emotional differences that Moore describes:

Demographically those people may be very similar, but their attitudes, career goals and emotions are entirely different. To an early adopter you can successfully make the pitch “Be the first in your industry to use our innovative product!” To a member of the mainstream market that may be the worst possible message.

Companies research the specific words that will spark customer emotions and inspire them to act. Messages with those words can produce 50 to 100 percent more responses than those without them.

For both consumers and people working in companies, attitudes are more important than demographics. Learn about your customer’s attitudes and emotional triggers.

Developing customer personas

Once you’ve done your research, including talking with actual customers, you will want to develop buyer personas that will help keep your marketing team – and your entire company — focused on who your customer is and what they want from your company, its products, and content.

Personas are actionable profiles of customers, based on research, that describe their attitudes, demographics, reasons for buying, and goals. These are not real people, but composite profiles that represent a significant portion of your customers. Developing personas is central to refining your customer understanding. If you haven’t done this before, it’s typically best to start with just three to five personas.

Your senior executives, product development, and sales teams should be part of your persona development because they all need to buy in to and use the personas. It will make a big difference throughout a B2B company, for example, if you decide that your target market and personas are with small office/home office (SOHO) customers or large enterprises. For a B2C company, just consider the differences if you’re selling to a discount shopper or a luxury customer. Ultimately these personas are driven by, or drive, your entire corporate and product strategy.

For B2C companies your buyers will typically be individuals, or possibly a couple. For B2B companies your buyer is often a team that may include line of business managers, end users, people in finance, inhabitants of the C-suite (CEO, CFO, etc.), maybe someone in procurement, and so on. You may ultimately need to develop personas for each of those so you can create more effective marketing and materials for your sales team.

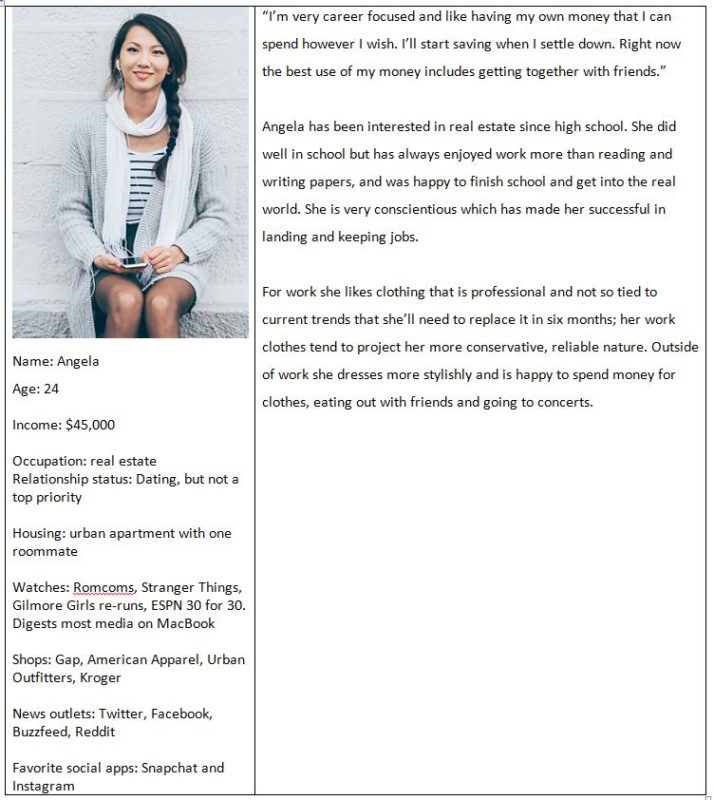

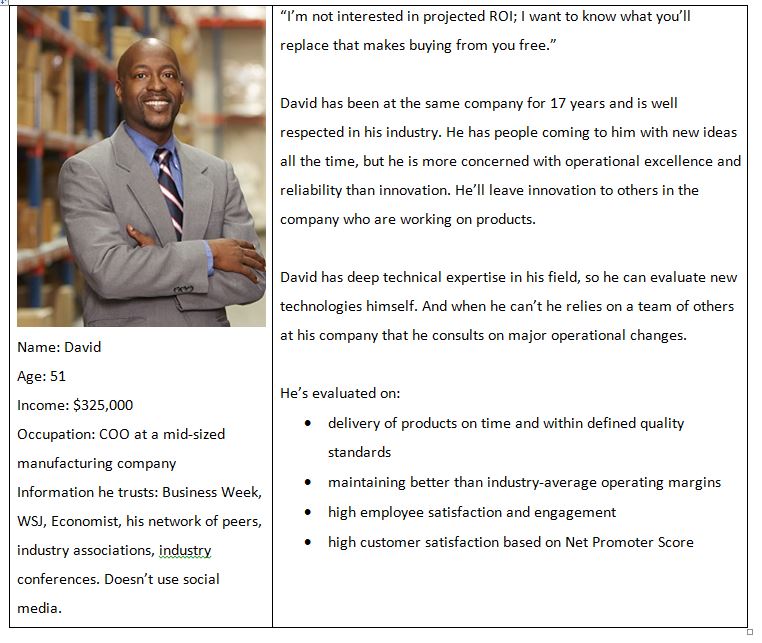

Here are a couple of sample personas.

For an apparel company:

And for an industrial company…

Different marketers put different content into their personas, and it can vary considerably by industry. For example, to better understand their customer some marketers include a “day in the life” section. Some people use categorical names like “Designer Danielle” or “Retiree Ron”. We’ll go over other matters that you may want to put into your personas shortly.

Personas are useful for taking that huge number of potential, faceless customers and putting a face on them. They clarify who you are speaking and selling to. They should be helpful for your marketing team when they are creating campaigns and content.

And remember: base your personas on actual research, not just what you imagine.

If you Google “questions when creating personas” you’ll find links to articles with five, eight, 20, 55, 100, even 150 questions to consider, although some of the 100+ suggested questions include such unknowable or low-value ones as Where does he fall in the birth order; Did his parents have a permissive parenting style; and Did he enjoy his college experience. There is no one way to do anything that I discuss in this book, but the following should help you find your way when creating personas.

Here are some demographic factors to consider when creating the personas of consumers:

- age

- gender

- sexual orientation

- level of education

- where they live (cities and states; urban, suburban and rural)

- jome ownership status

- employment status, income and net worth

- relationship status

- do they have children

- where they get their information and what they do for entertainment (favorite websites, TV shows, movies, artists, etc.)

For a particular product or service you may want to focus on other considerations that could be important such as race, whether they’re religious, their political orientation, are they concerned with being fashionable or casual in their style, what kind of food do they eat, what do they do for fun, are they tech savvy, are they looking for bargains or status purchases, and so on.

Matters of attitude are more important than demographics. You can have two working, suburban, college educated, married 45-year-old white women with two children each who nonetheless have very different attitudes about work, child raising, nutrition, clothes, how to best spend their family’s entertainment and vacation dollars, the best cars, and much more. This is especially important because on average moms spend the most money in day to day family purchases while dads will have a much larger role in the purchase and maintenance of big-ticket items. Just the attitude of the mothers toward the most important attribute of a car – environmentally friendly versus safe versus sporty – could have a huge impact on which cars they’d consider.

Some of the attitudinal factors to consider when you create your personas include:

- Why do they buy your product (necessity, status, entertainment, etc.)?

- What are the most important considerations in the purchase?

- How often do they buy it?

- Is this a new or replacement purchase?

- An impulse or considered purchase?

- What is their attitude toward your brand

For B2B purchases the buying team might include five to 10 people, including

- CEO, COO, and CFO

- line of business manager

- IT Manager

- IT Specialist

- procurement

- internal End User

- others

B2B personas include such factors as:

- What’s their title and responsibility?

- What is their role in this purchase?

- What are their personal and professional goals?

- Are they a risk taker or risk avoider?

- RACI: Are they Responsible, Accountable, Consulted, and/or Informed on this purchase?

A value proposition for The Walt Disney Company

A value proposition is a useful way for a company to explain to itself and the world what it does and why it does it. As an internal instrument, the value proposition can serve as the North Star for people at the company, always guiding their actions. For the world the value proposition is central to the company’s brand: the promise that it is making to them.

The Walt Disney Company is one of the most valuable brands in the world but, surprisingly, it does not express a true, customer-focused value proposition. Repeatedly the company describes itself in terms such as:

The Walt Disney Company, together with its subsidiaries and affiliates, is a leading diversified international entertainment and media enterprise with five business segments: media networks, parks and resorts, studio entertainment, consumer products and interactive.

And this:

The company’s primary financial goals are to maximize earnings and cash flow, and to allocate capital toward growth initiatives that will drive long-term shareholder value.

There’s only one thing missing from those: the customer. The Disney descriptions are company- and shareholder-centric. While maximizing shareholder value is an important component of any public company, it only happens in the long run by providing a true value to customers.

A value proposition is a customer-centric statement that includes:

- What product or services does the company provide the customer?

- Who is the customer and how is that valuable to them?

- What is unique about the way this company provides that value?

This is a potential value proposition for Disney:

The Walt Disney Company provides magical, many-in-a-lifetime experiences for children of all ages.

These unique experiences are created through the ingenuity and storytelling ability of Disney employees and delivered in a consistent yet surprising manner. For decades people at Disney have delighted people by bringing to life such characters as Mickey Mouse, The Lion King, Belle, The Pirates of the Caribbean, Jessie, the students in High School Musical, and Anna and Elsa through media networks, parks and resorts, studio entertainment, consumer products and interactive. Not only do people interact with Disney creative across many media, but throughout their lifetime: people who grew up with Disney then in turn trust Disney to entertain and educate their children, too.

The Disney operational excellence, which is studied by companies in many industries, allows us to provide these experiences in a way that maximizes profitability and shareholder value.

This is a far more balanced value proposition that puts the customer — “children of all ages” – first. It provides some detail on what Disney provides and its goal: to delight the customer. And it also describes some of the unique creative and operational components of the company on which Disney builds to meet the needs of the customers and shareholders.

Taking a strategic role

Now that you’ve done a lot of research into your customers and market, you may be ready not just to develop and manage successful advertising and promotion campaigns but to take a more strategic role at your company. You should, ultimately, be able to help your product people and executives understand what your customers want, how much they may be willing to pay for it, how providing that would differentiate you from your competition, the size of your potential market, and other critical matters.

Many people have a fundamental misunderstanding of marketing. They equate marketing with advertising and promotion. And they think its sole purpose is to help increase the awareness of the company and close new accounts.

Marketing should have a much deeper and more profound role in a company, and as a Bullseye marketer you know that advertising and promotion to new accounts are often some of the last things that you should be doing.

That is the ultimate role of marketing. But it isn’t the primary focus of this book. So we’re not going to spend a lot of time on product and corporate strategy. But do keep in mind the bigger, strategic role that you should also play.